Typically a slow month, August market activity was further affected by concerns around rising interest rates and inflation — however, there are early signs of a spring lift

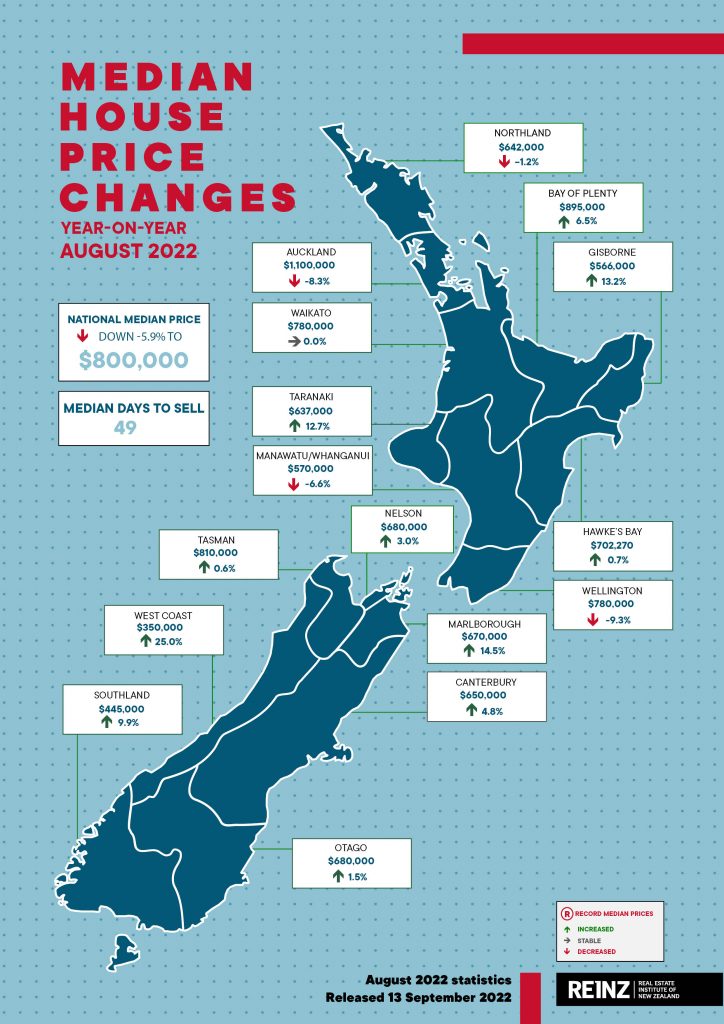

The latest data and insights from the Real Estate Institute of New Zealand (REINZ) finds that across New Zealand, median prices for residential property (excluding sections) decreased 5.9% annually, from $850,000 in August 2021 to $800,000 in August 2022. Month-on-month, this represents a 1.2% decrease from $810,000 in July. The seasonally adjusted figures show a 2.1% decrease in the median price as we moved from July to August, suggesting weaker performance than expected.

The median residential property price for New Zealand excluding Auckland remained unchanged compared to last year at $700,000. There was a month-on-month decrease of 2.8% from $720,000.

Four regions had an annual decrease in the median price in August 2022. Auckland’s median price decreased 8.3% compared to August last year, down from $1,200,000 to $1,100,000. Six of Auckland’s seven territorial authorities (TAs) had a negative annual median price movement in August. Down 13.4%, Waitakere had the greatest decrease, followed by Auckland City where the median price was down 12.3%.

In Wellington, the median price was down 9.3% annually, from $860,000 to $780,000 in August 2022. Seven of the region’s eight TAs had negative annual median price movements. Carterton saw the median price decrease 25.5%, while Wellington City was down 21.8%. The Manawatu/Whanganui region was down 6.6% from $610,000 to $570,000, and Northland saw a decrease in the median price of 1.2% from $650,000 to $642,000.

All other regions saw annual increases in median price. West Coast recorded the greatest percentage increase in the median price — up 25.0% from $280,000 to $350,000. The median price in Marlborough increased 14.5% from $585,000 to $670,000, and Gisborne saw the median price increase 13.2% from $500,000 to $566,000.

Four TAs achieved record medians. More information on activity by region and TA record median prices can be found in the regional commentaries section of the Monthly Property Report.

Jen Baird, Chief Executive at REINZ, says four of the 16 regions reported annual decreases in the median price.

“With two of those four regions major markets — Auckland and Wellington — affecting the annual movement in the national median price.

“Since the peak in November 2021, we have seen median prices ease. In the past six months, the median price across New Zealand has decreased by 9.6%, while Wellington has seen a decrease of 21.6% — from $995,000 in February 2022 to $780,000 this month. These are the greatest six-month drops each has experienced since REINZ records began in 1992.

“Despite the median property price easing across the country and supply increasing, sales activity remains subdued. These positive aspects for buyers are offset by higher mortgage rates as rising interest rates and concern around inflation continue to put the brakes on for many potential buyers,” observes Baird.

“That said, some real estate agents are reporting an increase in open home attendance. And while owner occupiers remain a dominant force in the market, first home buyers are beginning to re-emerge. As sellers adjust their expectations to meet the market, now is a great time to consider upsizing or downsizing. Although affordability remains a challenge, the relaxing of the Credit Contracts and Consumer Finance Act (CCCFA) and opportunity to negotiate are attracting savvy first home buyers.

“August tends to be a quieter month — as we move into the warmer months, we expect to see a usual spring lift,” Baird says.

Sales activity down

Across New Zealand, the number of residential property sales decreased annually by 18.3%, from 5,983 in August 2021 to 4,891 in August 2022. Month-on-month, there was an increase of 1.9%. The sales count for New Zealand excluding Auckland decreased 4.2% annually from 3,565 to 3,414. There was a 2.5% increase compared to July 2022.

On August 17, 2021, New Zealand went into a COVID-19 level four lockdown, which is impacting annual comparisons.

Several regions saw an annual increase in sales activity. Gisborne had the most significant increase up 72.7%, from 22 in August 2021 to 38.

Those with the greatest annual percentage decrease were:

- Auckland, which decreased 38.9% annually from 2,418 to 1,477

- Marlborough, which decreased 30.0% annually from 60 to 42

- Waikato, which decreased 18.1% annually from 568 to 465

- West Coast, which decreased 15.0% annually from 40 to 34.

“Sales activity was slow through August — sales across New Zealand were down 18.3% compared to August last year. However, there was significant variation across the regions, largely due to comparison with August 2021 which was affected by a nationwide level four lockdown.

“While affordability and access to finance remain an issue for many, these factors are compounded by rises in mortgage rates, recession fears and high inflation which are also curtailing activity. Vendors are increasingly realistic with their asking prices, however, demand remains dampened due to mortgage rates and continued affordability concerns.

“Agents across the country are reporting that whilst owner occupiers continue to dominate the market, first home buyers are returning indicating there is a pool of interested buyers there,” Baird says.

REINZ House Price Index shows decrease

The REINZ House Price Index (HPI) for New Zealand, which measures the changing value of residential property nationwide, showed an annual decrease of 5.8% from 3,997 in August 2021 to 3,765 — down 12.0% from its peak in November 2021.

For New Zealand excluding Auckland, the HPI decreased 3.2% annually — from 4,030 in August 2021 to 3,902 in August 2022.

Five of the 12 regions had a negative HPI movement, with Bay of Plenty joining Auckland, Manawatu/Whanganui, Gisborne/Hawke’s Bay and Wellington in negative annual movements. Auckland saw an annual decrease on the house price index of 9.5% — from 3,954 to 3,577.

Wellington was down 17.1% on the index compared to August last year — from 4,218 to 3,497, the third largest annual drop in HPI of all regions since records began. Wellington has now ranked bottom two of all regions on the HPI for 10 consecutive months.

Northland topped the index, up 7.9% compared to last year. Taranaki recorded an annual increase of 5.9% — ranking second on the index.

Median days to sell remains high

Across New Zealand, the median number of days to sell (DTS) a property in August was 49 — up 18 days compared to August 2021. For New Zealand excluding Auckland, DTS increased 19 days to 49.

With a median DTS of 36, Canterbury had the lowest median DTS of all regions and saw an annual decrease of eight days compared to lockdown impacted August 2021. All other regions had a median DTS of over 40 days. Nelson had the highest median DTS at 63, followed by Wellington and Bay of Plenty both at 59.

“Properties are staying on the market for longer. Enlisting a trusted real estate professional to effectively market your property so it stands out and attracts buyer interest is vital to achieving a successful outcome,” Baird says.

Inventory levels continue to trend upwards, listings down

The total number of properties available for sale across New Zealand increased by 107.7% annually, from 12,249 in August 2021 to 25,441. For New Zealand excluding Auckland, inventory increased 130.4%, from 6,595 to 15,196.

All regions bar Southland saw inventory levels increase by 50% or more in August 2022 compared to the same period last year. Southland saw an annual increase of 47.0%.

Nine regions had over twice the inventory they recorded in August last year. For nine consecutive months, Wellington and Manawatu/Whanganui have had over twice the inventory recorded in the same month the year prior — up 181.6% and 145.6%, respectively, in August 2022 compared to August 2021. Nelson had the largest percentage increase in inventory, up 194.3%, Hawke’s Bay was up 171.7%, Bay of Plenty was up 170.2%, and Waikato saw inventory rise by 169.0%.

Listings were up 15.2% across New Zealand in August 2022 compared to the same period last year, while New Zealand excluding Auckland saw an annual increase of 21.3%. Bay of Plenty saw the greatest annual increase — up 62.0%, while the greatest annual decrease was in Marlborough — down 37.5%. The number of listings in August 2021 was impacted by COVID-19 lockdown.

“The number of available properties for sale has continued to increase since the end of 2021, primarily because stock is staying on the market longer. The median days to sell a property nationally is now 49 days — up 18 days compared to the same time last year.

“The number of homes for sale in August increased 107.7% annually, while the number of new listings increased 15.2% compared to August 2021. More stock on the market has lessened the urgency to buy. Buyers have more time to shop around and undertake due diligence, and in the current market feel more confident to negotiate on price.

“Some would-be vendors who do not need to sell are choosing not to, anticipating a more favourable market. We are now reaching a point where would-be sellers are hesitant to list their homes, and those who do are increasingly pricing to meet the market,” Baird says.

Inventory and listings data come from realestate.co.nz.

Sales by auction remain subdued

Nationally, 461 properties sold by auction in August 2022, representing 9.4% of overall sales compared to 25.4% in August 2021.

New Zealand excluding Auckland saw 252 properties sell by auction, 7.4% of overall sales in August 2022 compared to 16.2% the year prior. Auctions represented 14.2% (209) of sales in Auckland, down from 38.9% in August 2021 — the lowest representation of sales by auction in the region since May 2020.

Gisborne saw 26.3% of properties sell by auction — the highest percentage of sales by auction of all regions, followed by Canterbury, where 18.9% of properties sold by auction.

“Auctions are a great way to see the current market in action. They provide a fixed date and a transparent sales process. In the current market, those choosing to sell by auction are serious sellers — not just there to test the market. Where you have a genuine buyer and seller in the room, properties are selling.

“Vendors are adjusting price expectations to meet the market as it is now. However, buyers remain cautious. This means we are hearing of a growing number of properties pass in and go to post-auction negotiations as buyers hesitate in the auction room,” concludes Baird.