Commercial property market sentiment across Oceania has moderated significantly in both Australia and New Zealand but headline momentum still remains modestly positive, according to the RICS third quarter survey.

The outlook for prime office space remains broadly positive, however forecasts for retail rents and capital values are much more subdued.

Valuations in Australia and New Zealand continue to be seen as expensive, while more respondents in New Zealand see the property cycle in the early stages of a downturn.

The latest RICS Global Commercial Property Monitor for the third quarter of 2017 reflected more subdued sentiments across Oceania.

Although headline momentum remains positive in the near term, some segments of the market are showing signs of a downturn as valuations continue to be seen as expensive and credit conditions deteriorate.

Respondents to the Property Monitor indicated that momentum in Australia and New Zealand remained moderately positive in the near term, although the outlook has been revised significantly lower in recent quarters.

This may be partially due to valuations continuing to be viewed as being above fair value to some degree, while credit conditions continued to tighten.

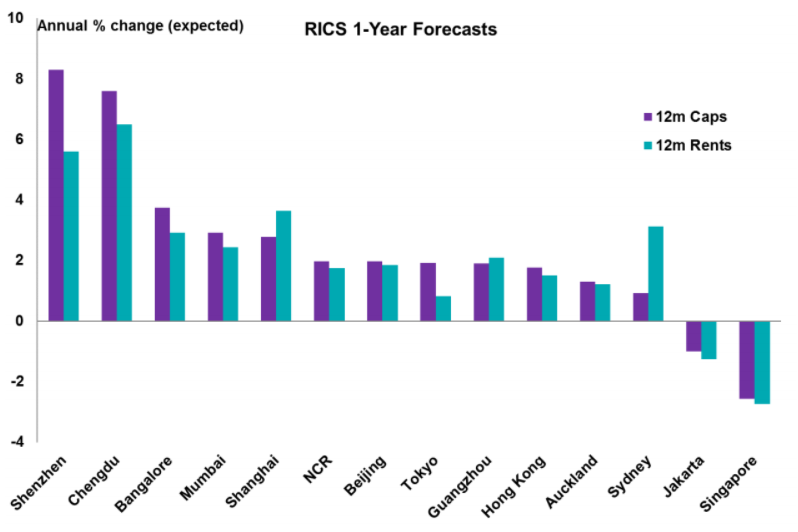

Contributors indicated that investor demand for prime office space in core Asia-Pacific locations continue to support the investment market in key cities such as Sydney and Auckland.

However, there are signs that momentum in the occupier market in New Zealand is being broadly driven by expectations rather than fundamental supply and demand.

“Industry sentiment remains highly nuanced across Australia and New Zealand and the overall longer-term outlook for commercial property markets in Sydney is rather subdued,” RICS Oceania managing director Stephen Albin.

“The survey results suggest some core markets such as Sydney and Auckland may see growth start to moderate in coming quarters, especially as valuations continue to be seen as expensive and credit becomes more difficult to attain.

“Interestingly, we can also see some divergence, particularly for Sydney versus the wider region, between expectations for rents and capital growth.

“Whilst demand is strong for both investment and rental commercial property stock in Sydney, it’s likely this divergence is a result of tightening supply conditions,” Mr Albin says.

The full report is available on the RICS website www.rics.org/economics

About RICS Commercial Property Monitor

RICS Global Commercial Property Monitor is a quarterly guide to the trends in the commercial property investment and occupier markets. The sentiment index introduced by the RICS economics department allows tracking of commercial property trends.