Though almost $100 billion worth of property was put up for sale last year, this was a substantial drop compared with 2022, realestate.co.nz Chief Executive Sarah Wood says

It’s clear that people who didn’t need to sell property in 2023 preferred to sit on the sidelines.

$97,015,251,805 worth of property was put up for sale, which is the sum of asking prices on all residential dwellings listed on realestate.co.nz during the year. This was a 22.8% drop from the $125,601,880,575 listed in 2022.

Down by almost a quarter compared to 2022, this decrease in total value was two-fold, with fewer listings coming onto the market and lower asking prices.

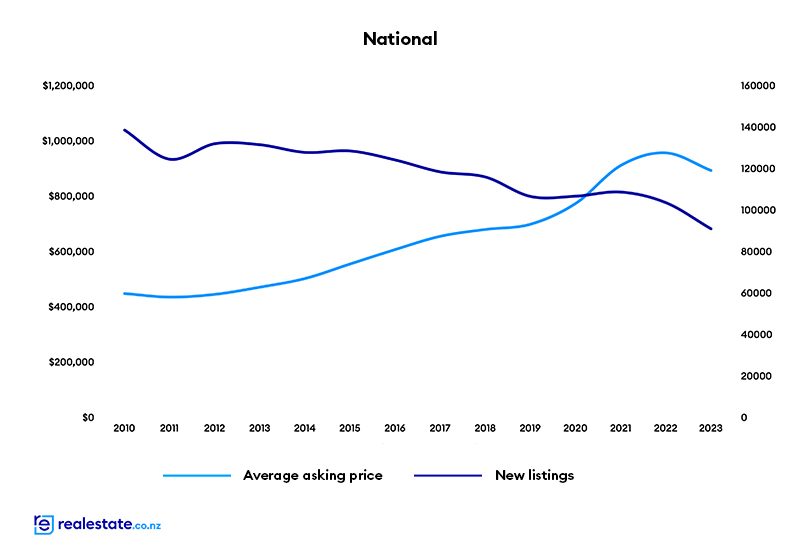

Around 90,000 properties were newly listed during 2023, a drop of 12.1% on 2022. It was a year of record new listing lows, with the first seven months and December all recording the lowest number of new listings for the month in 16 years of data (excluding Covid-19 lockdown).

At $895,289, the national average asking price was also down by 6.6% from $959,034 in 2022. This is the first time in more than ten years that the average asking price has dipped below the previous year.

In a year of uncertainty around economic conditions, ongoing interest rate hikes, and a cost-of-living crisis, it’s not surprising that fewer Kiwis decided to put their homes up for sale last year.

Equally, falling price headlines likely made any opportunistic sellers pause in anticipation of better times to come.

Fewer options for buyers in every region

All of our 19 regions had fewer new listings in 2023 than in 2022.

Buyers in Gisborne had the least choice, with the smallest number of new listings and the biggest year-on-year decrease for the second year in a row.

Across the region, just 361 new property listings came onto the market during 2023, a whopping 36.4% drop on the previous year.

Low supply didn’t increase prices in the region. Interestingly, we’ve seen low supply levels for a couple of years in Gisborne, but the average asking price for the region was back by just over 4% year-on-year. It’s likely that extreme weather events affecting the region in early 2023 are continuing to hamper market activity.

After Gisborne, Wellington (down by 24.0%) and Wairarapa (down by 19.5%) experienced the most significant declines in new listings last year. In contrast, Coromandel, Nelson & Bays, Marlborough, Canterbury, and Southland were the regions least impacted, with new listings in each region decreasing year-on-year by less than 5%.

In every market, there will be people who need to transact. According to the Real Estate Institute of New Zealand, a total of 63,361 residential properties were sold in 2023, a slight increase of 0.6% compared to 2022.

While fewer homes came onto the market and changed hands, there was no waning Kiwis’ interest in property.

The number of New Zealand-based property seekers active on realestate.co.nz in 2023 was up by 6.5% compared to 2022.

Popular regions exempt from market correction

While most regions across New Zealand experienced falling prices, some standouts continued to command higher prices.

West Coast, Central Otago/Lakes, and Marlborough were the only three regions to see year-on-year average asking price growth in 2023.

Our most affordable region, West Coast, had the largest year-on-year increase of 6.1% but remained the only region below $500,000, with an average asking price of $467,361 for 2023.

On the contrary, Central Otago/Lakes, which sits at the opposite end of the price scale, continued to buck the trend of falling prices in 2023 with a 12-month average asking price of $1,463,453 in 2023, (up 1.9% on 2022).

In July, the region became the first in New Zealand to surpass a $1.5 million average asking price. By December 2023, it hit a record high of almost $1.6 million.

Prices in Central Otago/Lakes have been trending upward since the beginning of 2022. Touted as one of the most naturally beautiful places in the world, property within Central Otago/Lakes seems exempt from market conditions as demand continues to soar.

We know from buyer search data that a significant amount of interest comes from offshore, and it may be that favourable exchange and interest rates mean these buyers have more to spend than many New Zealanders.

The regions to experience the biggest falls in asking prices in 2023 were Auckland (back by 9.5%), Wellington (back by 9.0%), and Coromandel (back by 6.8%).

While it’s common to see the bigger centres like Auckland and Wellington affected by market cycles, Coromandel’s spot within the top three could be down to the weather events, which effectively cut off parts of the region for several months during the year.