The Reserve Bank of New Zealand has signalled an end to further rises in the Official Cash Rate (OCR) – Colliers explores what this could mean for property investors

What Now for Yields as Peak in OCR is Signalled

Having raised the cash rate at the most aggressive pace in its history, the Reserve Bank of New Zealand (RBNZ) has signalled that it has reached the top of the cycle. This will encourage the view that property yields have also reached their cyclical peak, further movement, albeit limited, however, may be expected over the short term.

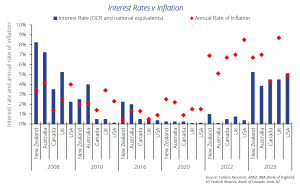

The return of inflation ends the period of low interest rates

The GFC that began in 2008 prompted central banks in Western economies to slash interest rates as a means to bolster their struggling economies. Over the following years, economic performance gradually improved, but interest rates remained at historically low levels.

However, when the Covid-19 pandemic hit, governments and central banks around the world swiftly implemented emergency measures to support their economies. One of these measures included aggressive interest rate cuts, driving them to record lows in numerous nations.

As economies cautiously reopened, a new challenge emerged: surging inflation. This inflationary trend has been attributed to various factors, such as disruptions in global supply chains, shortages of essential workers, and a surge in consumer spending coined as ‘revenge spending’.

Consequently, central banks found themselves compelled to increase interest rates. This move aimed to curb excessive demand within the economy and work towards restoring inflation to target levels set by policymakers.

New Zealand First to Start, First to Finish?

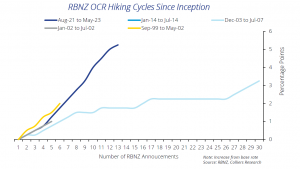

The RBNZ took swift and aggressive action as New Zealand was amongst the first countries to combat rising inflation by increasing interest rates. Starting from the Covid-19 induced emergency level of 0.25%, rates were lifted in October 2021, and at each of the subsequent 11 Monetary Policy announcements.

However, the RBNZ has indicated that the current OCR rate of 5.5% will likely be the peak of this cycle, and they anticipate initiating rate cuts in the third quarter of 2024. This announcement surprised experts who expected the recent surge in migration to fuel demand, contribute to inflation, and require further rate hikes.

In contrast, the RBNZ asserts that inflation has already peaked and will continue to ease. Although government investment is predicted to grow, the overall fiscal policy is expected to be contractionary. The RBNZ believes that demand in the economy is softening, citing a slowdown in consumer spending and an easing of residential construction activity. Furthermore, they foresee migration levels gradually returning to pre-Covid-19 trends in the coming quarters.

Property Values to Stabilise After Wild Ride

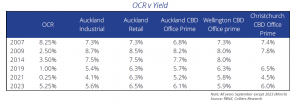

Property owners will welcome the Reserve Bank’s signal that the (OCR) has reached its peak, considering the significant impact that the rapidly rising rates have had on capital values. Over the period from early 2020 to late 2021, the value of assets, including commercial and industrial properties, surged primarily fueled by historically low borrowing costs.

The subsequent rapid increase in the OCR, however, has led to higher financing costs, causing a recalibration of yields resulting in a partial reversal of the capital gains previously generated.

The best illustration of the movement in yields is provided by the Auckland industrial market, given the relatively high number of sales. In December 2019, average yields for Auckland industrial properties stood at 5.3%, falling, by the end of 2021, to 4.1%. By March 2023, however average yields had risen to 5.6%. While yield movement varied across sectors and locations, the overall trend remained consistent.

Data released by MSCI reveals the impact of this cycle on property values. Average annual capital gains for all commercial and industrial properties peaked at 14.5% in the year ending September 2021. However, over the year to March 2023, average capital values declined by 6.3%.

Value variations across sectors also depend on rental trends, which mirror current demand dynamics.

In this respect the industrial property sector has been the strongest performer, with an extended period of tight market conditions resulting in significant rental growth over the past two years. This growth has mitigated the impact of rising yields on property values.

Rental growth has also been apparent within the prime grade sub-sector of the office market, driven by increased demand for high-quality office spaces as employees have returned to workplaces in increasing numbers. Conversely, the secondary office sector faces further downward rental pressure as vacancy rates increase.

The retail subsectors have displayed mixed fortunes, with strongly performing malls and large format centres experiencing mild rental increases. However, strip retail assets face challenges, as weaker demand has made it increasingly difficult for landlords to maintain rental levels.

Peak Yields in Sight

While the Reserve Bank has signalled the peak in interest rates, further upward adjustments to property yields may occur over the next few months. This is a result of property valuations lagging the movement in interest rates due to sufficient numbers of sales taking place as well as reporting lags and therefore it takes time for the full extent of changes to crystalise.

While, for many sectors, the risk premium between property yields and fixed interest rate alternatives sit at below longer-term norms, much of the adjustment has seemingly been made indicating that under current expectations of the peak in the OCR, peak yields are not far away.