JLL provides insights into how the retail, office and industrial and logistics markets have performed in Q1 2023 in the country’s biggest cities

Retail Snapshot

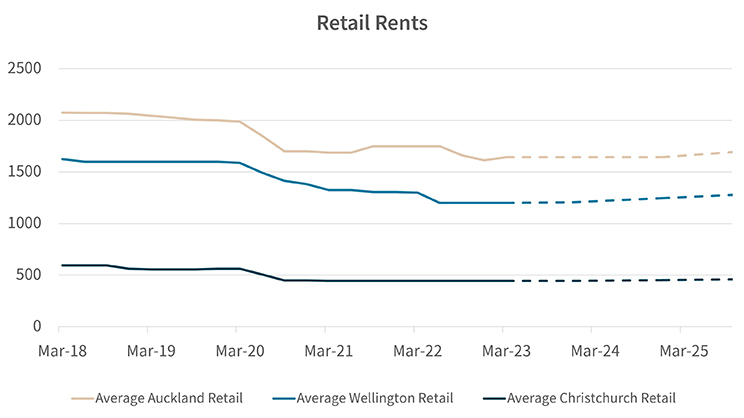

Following the shift to more online platforms due to the pandemic, many small-scale retailers have moved away from expanding in physical retail spaces to grow their businesses. This is stabilising rents, particularly in Auckland, where in the suburban segment, rents increased by $25 per square metre in Q1 of 2023 and are not expected to increase again this year. Existing vacant space needs to be taken up before rents start to increase at a significant rate. In Auckland’s CBD, prime retail rents increased 1.6%, being the first rise since 3Q21, expected to increase by over $100 per square metre in the next 24 months on the back of increasing demand.

Bulk retail continues to build on its strong performance from 2022, where it finished with rent growth in Q4 up 7.69%. Minimal space is in the pipeline in Auckland CBD aside from some smaller retail components in mixed-use developments, due to complete in 2023.

Retail activity is on the rise in Wellington and Christchurch, with Gear Street Union in Petone, and Te Matatiki Toi Ora in Christchurch signalling a trend for better, more accessible mixed-use spaces that include an inclusive retail/hospitality element. Over 5,000sqm of retail space in the Garden City, as well as the upcoming Willis Lane retail development in the capital, will potentially drive rents up, after consecutive quarters unchanged. These rent levels are expected to remain the same for the remainder of 2023.

Some of the questions answered in the latest report include:

- Where is retail resurgent in Auckland?

- What’s driving new retail developments in Wellington and Christchurch?

- How will mixed-use developments continue to provide impetus to retail and hospitality operators?

Office Snapshot

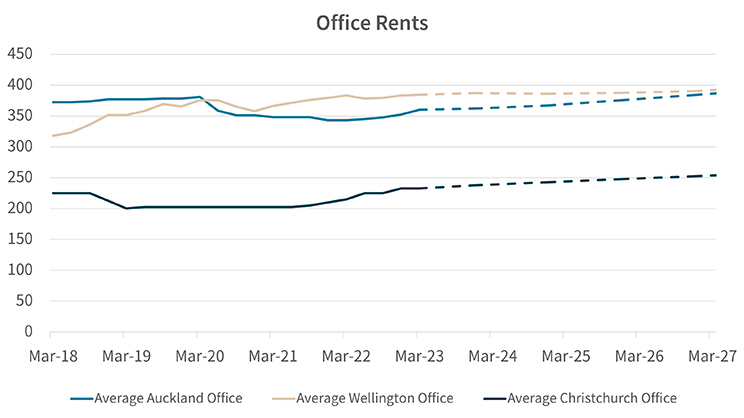

The trend of a diverging gulf between prime and secondary office space for lease continues as tenants and employers seek properties that are better equipped to attract and retain the best talent in the market. A general uptake in vacant space across the board, particularly in the prime segment, signals this trend continues to gain traction.

Furthering this narrative, net prime rents in Auckland’s CBD office market increased by $10 per square metre in Q1 of 2023. Vacant space continues to be taken up even with higher rent, and the tightening vacancies in the top end of the market are predicted to continue at the risk of higher vacancies in the secondary market.

Notable developments in Wellington’s office market include 44 Bowen Street being completed in Q1, leased to KPMG and Waka Kotahi. Several significant developments are in the pipeline to boost available premium space in the capital, including the Archives Building and BNZ Building. There is more than 24,000sqm of office space planned at 61 Molesworth Street as well, expected to be completed in 2025.

Minimal vacancy in the Garden City continues as the high demand for office space in the CBD remains. Some small office developments were completed in Q1, bringing around 2,000sqm of space to market. Existing buildings continue to be upgraded for seismic purposes – opportunities to enhance properties and ultimately add more desirable, resilient assets to the market.

Average net rents and yields slightly softened across most markets.

- What key developments are in the pipeline across our biggest cities?

- How are vacancies trending in the Garden City’s premium office precincts?

- What’s shaping Wellington’s office development pipeline?

Industrial Snapshot

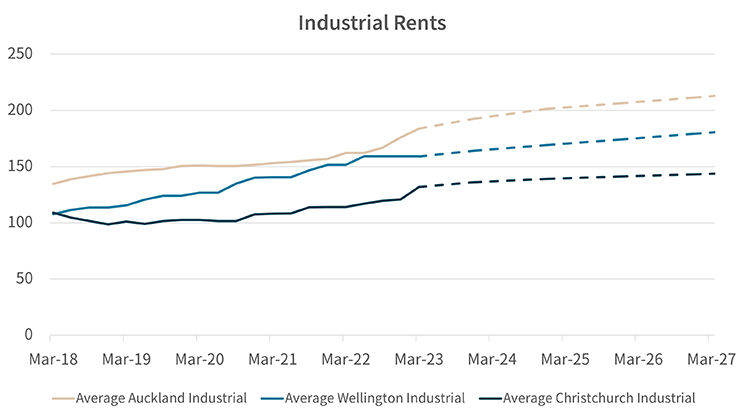

Over the industrial sector across Auckland, Wellington, and Christchurch, vacancies were down, and rents were generally up, highlighting the strength of this market segment. In Wellington, rents remained unchanged for the fourth consecutive quarter, however vacancies decreased by 0.3% (to 1.5%) – a greater change than in Auckland’s and Christchurch’s markets. The competitiveness of the industrial property sector continues due to consistent occupier demand exceeding new available stock due to higher construction costs and softening yields. All of these factors point to the ongoing strength in the market for well-located, quality stock.

Despite rising construction costs, the development pipeline is particularly strong in Auckland’s north and south precincts, with over 330,000sqm due to be delivered in the key southern industrial corridor, and over 70,000sqm lined up on the North Shore. The pipeline in Christchurch is also very strong, with over 200,000sqm expected over the next few years. By contrast, Wellington’s pipeline is limited, with only two significant developments underway that will add around 17,500sqm. The consistently tight market in the capital will enhance demand for new spaces further.

Notable completions for Q1 in 2023 include 35,810sqm of warehousing for Sorted Logistics in Wiri, and 7,450sqm of warehousing in East Tāmaki, a development called Highbrook Riverside.

Some of the questions answered in the latest report include:

- What factors are driving continued demand for industrial developments in south Auckland?

- Will rents remain unchanged in the capital through 2023?

- Which cities and precincts will see stronger yield performance in 2023?