Industrial precincts across the country have seen vacancy rates falling, rental rates rising and development activity surging as occupier demand for industrial workspace has boomed

Demand for industrial workspace has escalated over recent years driving vacancy rates to multi-year lows across the country.

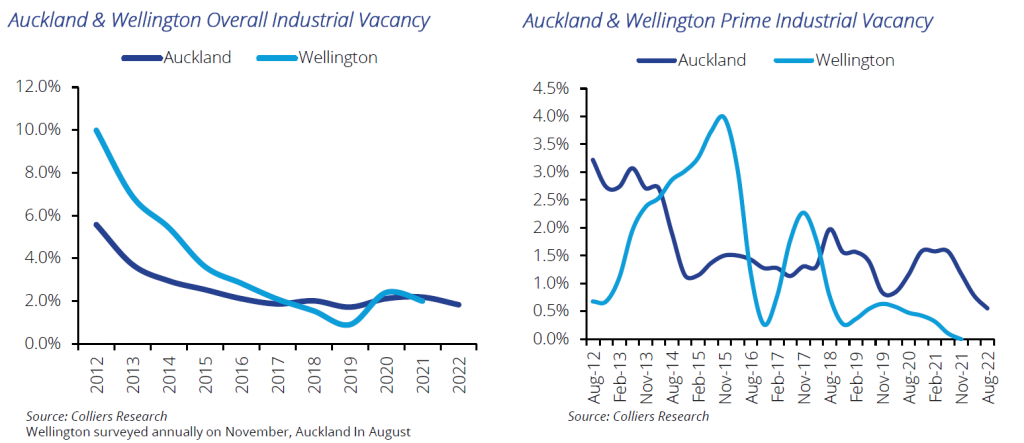

The tightening of market conditions in Auckland and Wellington are clearly illustrated by the results of vacancy

surveys conducted by Colliers Research.

The latest Auckland survey conducted in August showed overall vacancy across the region to be just 1.8%. The figure has sat at below 2.5% since August 2015. Conditions at the prime end of the market are tighter still with a vacancy rate of 0.6%.

In Wellington, similar trends have been in play with overall vacancy sitting at 2.0% in November 2021. Vacancy has been below 2.5% since late 2017.

It is not only the Auckland and Wellington cities that are experiencing these tight market conditions. Similar conditions are reported in most of the cities and provinces in the North Island and South Island locations that Colliers monitors.

Four key areas are driving the industrial sector forward, namely logistics, storage, construction and agriculture.

The logistics sector, in particular, has experienced substantial growth driven by the boom in e-commerce.

Figures released by NZ Post show that online spending in New Zealand over the June quarter of 2022 stood at $1.6 billion up by 52% on the corresponding period in 2019.

The rise in online retail has translated into additional demand for logistics warehouses and last mile delivery facilities.

By way of example, NZ Post set out to double its parcel handling capability in 2020 from 95 million per annum to 190 million. It has subsequently committed to leasing new premises in Wiri, Albany and Mount Roskill in Auckland, Grenada in Wellington and has upgraded its Christchurch facility.

Demand for storage facilities increased as a large number of businesses were forced to hold larger inventories.

The disruption to supply chains arising from the COVID-19 pandemic forced companies to move from a just in time distribution model to a just in case system.

Record levels of residential construction activity has driven a requirement for storage and manufacturing facilities. Businesses involved in supplying the construction sector have been in expansion mode as they scaled up production to meet demand.

Rising demand for specialist industrial premises is becoming increasingly apparent within some of the nation’s leading agricultural production areas. This is clearly illustrated by increased demand for pack houses, cool and cold stores resulting from expansion within the horticultural sector.

Stats New Zealand figures show that the area of land planted for horticultural production in the Bay of Plenty increased by 28.5%, to 14,431 hectares, between 2017 and 2020. Over the same period Hawkes Bay saw a 22.2% increase to 16,153 hectares.

Development sector responding but constraints increasing

Tightening market conditions and a positive outlook for many of the principal drivers of demand has elicited a strong response from the development sector.

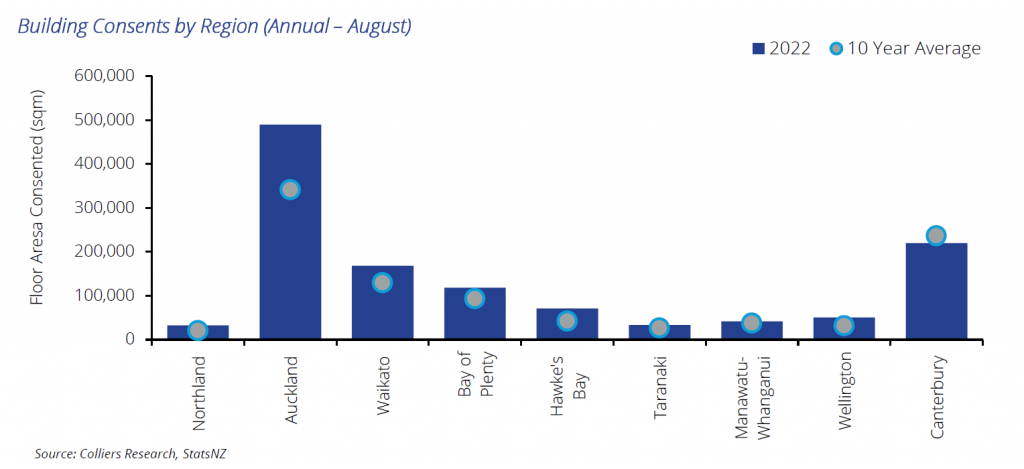

Over the year to August 2022 building consents were issued for the development of 1,369,115 sqm of new industrial premises across New Zealand. The 2022 figure is the highest recorded for an August year this century, 28.4% ahead of the average over the last 10 years.

The increase in development activity is common across many regions. Activity is greatest in Auckland where consents for the construction of 489,610 sqm of space have been issued in the 12 months to August, well above the 10-year average of 341,000 sqm.

In Hawke’s Bay, consents this year are running almost 70% ahead of the 10-year average.

Canterbury is the only major outlier with 2022 consents running at approximately 7% of the 10-year average.

This, however, reflects the period of elevated development activity which followed the 2011 earthquakes.

The challenge for the development sector will be to maintain current levels of activity given increasing constraints. A shortage of suitably zoned land is a common theme across many regions, particularly within established industrial precincts.

As a result, land values are rising. Building costs have been escalating rapidly. Stats NZ’s price index for warehouses and factories rose by 11.1% in the year to June 22, having risen 6% a year earlier.

The construction sector is experiencing significant skills shortages and, although beginning to ease, supply chain disruption continues to act as a drag on project timelines.

Rents on the rise

Increasing rental levels is another of the national themes playing out across the industrial property sector. The

pressure on rents is particularly acute at the prime quality end of the market.

In Auckland, average prime warehouses rents increased from $144 per sqm in the September quarter of 2021 to $160 per sqm in September 2022. Anecdotally, new build warehouses in premium locations could be moving towards new record levels of around $220 per sqm.

While the degree of rental increase varies across regions and, indeed, precincts, increases of between 6% and 12% between mid-2021 and mid-2022 have become more common.

The lift in development activity will see pressure on markets ease over the medium term but a continuation of rental increases can be expected over the balance of 2022 and into 2023.

Yields ease as interest rates rise

Low vacancy rates, high levels of tenant demand and rising rents have positioned industrial property as a prime

defensive investment asset. As a result, competition for properties brought to market has been intense with property funds, high-net-worth individuals and syndication companies all looking to increase their exposure to the sector.

The elevated levels of demand saw yields falling to historically low levels. Despite this, risk premiums were preserved as interest rates were cut aggressively by the Reserve Bank of New Zealand (RBNZ). In the Auckland market, average prime investment yields fell to a low of 3.75% in late 2021.

Elsewhere in the country a similar tightening trend in yields was apparent as demand for industrial assets increased.

With the RBNZ now increasing interest rates, at pace, in an inflationary environment, a recalibration of yields has begun. To date, the impact on property values has been partially mitigated by rising rental levels.