Last year, CBRE polled more than 20,000 people worldwide on how they want to live, work and play, but are the results applicable to New Zealand and how can they help guide strategies going forward?

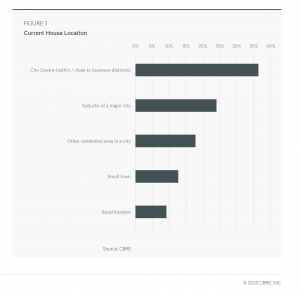

More than a third of respondents live in a city centre

(within/close to business districts).

Global cities are fundamentally different to New Zealand cities which makes the geographic boundaries difficult to compare. Regardless, the themes around location preferences are transferrable across geographies and provide important insight. We consider ‘city centre’ to be more comparable to the Auckland isthmus, and ‘suburbs of a major city’ relevant to other suburbs in the Auckland urban area.

The survey showed that 36.4% of global respondents live in a city centre, with a further 24.0% living in the suburbs of a major city. Relatively few (9.2%) live rurally.

Education levels have a strong impact on the location results. For respondents with no formal education, they are most likely to live in a small town, whereas more than half of respondents with a PhD qualification live in a city centre.

Income level has a similarly strong correlation with dwelling location. 12.5% of low income households live rurally, compared to 7.2% of mid income households and 3.1% of high income households.

Age has less of an impact than education and income indicating that it is easier to achieve this type of diversity across geographic boundaries. The most common location for all generations except Baby Boomers was a city centre. The proportion of people living in a city centre increases up until a person is in their early 30’s before slowly declining in favour of the suburbs.

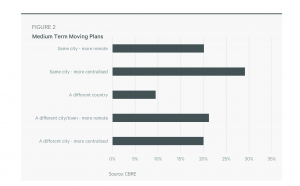

Global centralisation is getting stronger

City centres as the primary desired residential locations have strengthened since the pandemic and there are indications that this will continue. A quarter of respondents moved to a new house within the last two years, and of those that did, the largest proportion have moved to a more central location in the same city. A third of people are planning to move within the next two years, and once again ‘same city – more centralized’ is the most common response.

Implications for New Zealand cities

Global preferences don’t always apply locally however in this case the desire for more central locations is evident in responses from nearby Australia and especially from across Asia. Respondents in these countries indicated that being in the same city in a more central location was preferable to other options. This bodes well for future housing demand in New Zealand cities such as Auckland which despite recent price falls remains the most expensive region in the country.

Immigration policy could accelerate some of the centralization that New Zealand cities are experiencing by bringing in a demographic that has demand for city centre living. Targeting of educated and/or high income immigrants for whom the survey has shown to be a significant proportion of a city centres population could further increase demand for housing in New Zealand cities.

Higher cost of city centre living is traded off with other tangible benefits such as proximity to a wide variety of goods and services as well as greater investment into public amenity. In trading off the benefits of city centre living with the disadvantages, the global survey has shown that for most people, city living prevails.

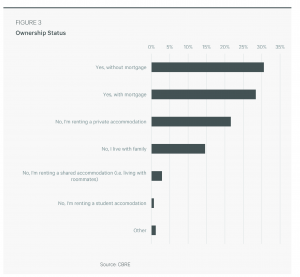

Ownership preferred

Most of the global respondents own their home. 59% of the survey respondents own their home, either with or without a mortgage. This compares to 65% for New Zealand as at the 2018 Census.

The proportion of people who own their home increases with age. Younger people tend to rent or live with family. As people move through the education system they become less likely to live with family and more likely to rent or own. Interestingly, for Gen-Zers undertaking postgraduate studies at University, more than half of them own their home despite their young age. It is probable that they receive financial support from parents for this.

The likelihood of being mortgage free increases with income level and age. 48.1% of Baby Boomers own their home outright, compared to 24.2% of Millennia ls. Outright ownership is lower in countries with a secure long term rental markets such as Finland (12.9% own without a mortgage), Sweden (12.4% own without a mortgage), and The Netherlands (7.8% own without a mortgage).

New Zealand home ownership is declining

The home ownership rate in New Zealand has declined over the past three decades, moving from 74% in 1991 to 65% in 2018. Strong residential price growth from late 2019 to late 2021 means that this trend of decline is likely to be observed in the results of the 2023 Census; although prices have fallen throughout 2022, a doubling of mortgage interest rates keeps cost high. CBRE’s 2016 millennial survey showed that New Zealanders do have a strong desire to own their own home. However, the high value placed on location and quality of life means that people are willing to trade off tenure for this.

What does this mean for Build to Rent?

With a declining home ownership rate is a higher proportion of households living in rental housing. More participants in the rental market means a larger and broader demand base for purpose-built long-term rental housing.

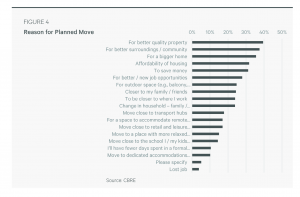

A major theme coming out of CBRE’s Live Work Shop survey is that post pandemic values around living have changed. Quality of life is a top consideration – people want to live well and enjoy their daily lives. Home ownership may be a goal, but it is being pushed out. People are less willing to accept a poor quality of life with achieving home ownership earlier in life.

The themes and results of the global survey are supportive of build to rent housing. High quality residences in central locations are extremely important, alongside health and safety and spaces that support a hybrid work environment. Transience of the growing renter community also provides opportunity to attract occupants with a superior new build offer. The survey data showed that 48.1% of renters plan to move in the coming two years. While some will move into ownership, the top ranked feature that renters are seeking is a better quality property (40.9%) followed by better surroundings/community (36.2%). These priorities are also true for owners who are looking to move.

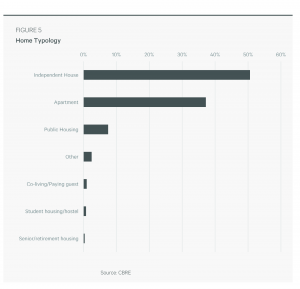

Typology tipping point

50.6% of total respondents live in an independent house however the proportion for owners is 62.0% and for renters it is 24.7%.

With urbanization on the rise globally there will soon be a tipping point where non-independent house typologies accommodate most of the population.

New Zealand is several decades away from reaching this. The only apartment market of scale is in Auckland, with 7.6% of all dwellings being apartments. This market has experienced significant growth since the early 2000’s when apartments comprised 1.9%of total stock. In comparison, 45.7% of European respondents live in an apartment.

Outside of geography the major determinant of typology is tenure. More than half of Millennial and Gen-Xer renters live in apartments. Even Baby Boomer renters are predominantly in apartments, however, there appears to be a preference for independent housing if income allows. 19.6% of low-income Baby Boomer renters live in independent housing compared to 45.8% of high-income Baby Boomer renters.

The prevalence of remote work has accelerated throughout the pandemic, however only 60.8% of survey respondents noted a dedicated work/study area in their home. While income group is the main determinant of whether a dedicated home workspace is present, preferred work style also influences the likelihood of having a suitable space. 78.9% of people who prefer entirely remote work have a dedicated work/study area, compared to 47.9% of people who prefer entirely office-based work.

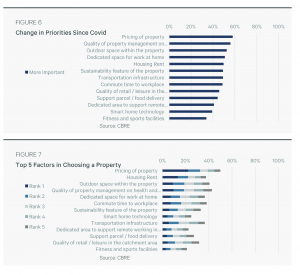

Covid has changed priorities in living

The Covid-19 pandemic has had a direct impact on global housing priorities. Several property features that were previously considered to be nonessential ‘nice to haves’ have increased in importance to be key drivers of property decisions. Quality of property management on health and safety, outdoor space, and having a WFH space has become more important for over half of the people surveyed. Figure 7 shows that these three factors are now primary considerations for many people when they are choosing a property.

Younger generations especially value good property management. Almost two thirds of Gen-Zers and Millennia ls consider this to be of increased importance, including over 70% of high-income Millennials.

Despite an increased importance of various property features, an inflexible constraint is price, either for ownership or rent. These two factors have been identified as the most important for survey respondents. For renters across all age groups, price has had the largest increase in importance.

How to be competitive as a developer

People want spacious, high-quality residences in central locations that support personal wellbeing, good health, and a flexible work environment. Critically, they need to be able to afford the dwelling and find it an attractive offer compared to other options in the market. The challenge for developers is being able to fulfil this criteria profitably.

Declining land values provide an opportunity to secure urban sites at lower cost. City suburbs that are adjacent to more desirable or expensive suburbs have potential for housing that features several of the factors that people consider important while enabling their development/maintenance cost recovered in sale price or rent. Including property features that have increased in importance since Covid with only a slight compromise on location could draw buyers from adjacent suburbs that they consider to be equally affordable but that do not provide several of the features deemed important.

Conclusion

The survey produced data on some of the theories arising since Covid as to how people want to live, work, and shop in the future. While it is true that many people have a technology enabled capability to work remotely, and could access more affordable housing by doing so, most people prefer to live in centralized areas that are well connected. They also desire home ownership, but greater emphasis on post pandemic quality of life and continued lack of affordability is pushing achievement of this goal further into the future.

A compromise is denser housing typologies which enable quality of life within financial constraints. In the New Zealand context, this means more terraced houses. Value placed on private outdoor space is met, along with location, quality, and community. This typology will be supported by apartments in locations where the higher build cost is absorbed by effective demand.

Amenity is key

Location plays a central role in deciding where people live because having access to a wide variety of quality amenities is important. Cities provide a hub of amenity and for this reason they will prevail.

Over the past few years city suburbs in New Zealand cities have been gentrifying. A desire for ownership among young people priced out of the market has shifted them to the periphery. Suburban town centres had been in decline over the past few decades as business centralized into CBD’s and regional malls, however work from home and the ‘support local’ movement has breathed new life into them.

In 2023 we expect to see a greater level of amenity incorporated into new housing development. Amenity may be provided at an individual property level, but this is expensive. It is more likely that developers will leverage existing amenity or incorporate new amenity at a building or community level. This aids overall affordability while retaining quality of life.