Despite another increase to the Official Cash Rate, paying off a mortgage is still preferable than staying in the rapidly rising rental market

Another OCR rise won’t dent the enthusiasm in the property market, says Century 21 New Zealand Owner Tim Kearins.

“That’s because for the likes of first-home buyers paying a mortgage remains comparable, or even cheaper, than paying the record-high rents we’re seeing nationwide.”

On November 24 the Reserve Bank once again lifted the Official Cash Rate by another 25 basis-points to 0.75% – marking the second consecutive OCR hike by the central bank in over seven years.

“While banks have already increased their interest rates in anticipation, they’re nonetheless heading on an upwards track. That will only see buyers more motivated to act, making the most of low interest rates this summer.

“People are waking up to the fact that they can either buy and set their interest rate at say 4.5% or wait and pay 6% – which is 33.3% more. Further, many pundits doubt property prices will drop, so waiting is now not much of an option.

Meanwhile, Trade Me last week released its latest Rental Price Index which confirmed national rents hitting new highs, with the median weekly rent on its site at $560 in October – up 8% in 12 months. At the same time Auckland’s median advertised weekly rent hit $600.

“Those contemplating selling their properties can now also see it will be a strong summer, while 2022 remains not so clear,” says Kearins.

“Hence Century 21 is expecting many Kiwis to push play on selling their property in the next two or three months.”

CoreLogic NZ Chief Property Economist Kelvin Davidson says attention will now quickly turn to what’s next, and when/how high the peak for the OCR might ultimately be.

“The forecasts from the RBNZ suggest a peak of around 2.5% in late 2023, but you’d have to think that this peak could be reached sooner and/or be higher, especially with the announcement from Government that borders will reopen in the first half of 2022.

“For the residential property market, the implications are clear – there are further mortgage interest rate increases to come. With most shorter term fixed rates now pushing up towards (or above) the 4% mark, we’ve already seen them pretty much double from the previous lows, and figures of 5% or more wouldn’t be a surprise over the next 6-12 months either.

“Of course, that’s still low by past standards. And borrowers rolling off loans agreed perhaps two years ago, and/or who kept their repayments the same even as rates fell in 2020, may not see much change.

“However, many borrowers on rolling one-year terms could see a significant shift in mortgage costs. In fact, according to RBNZ data, $227.8bn in mortgages are either floating or due to roll over in the next year. This equates to 71% of all lending – a lot of funding which when refixed will likely lead to greater mortgage repayments and subsequently less disposable income.

“Overall, with unemployment still low, the housing market isn’t necessarily headed for a crisis. But there are certainly headwinds (e.g. higher mortgage rates, and tighter lending rules such as potential debt to income ratio caps) which will likely lead to a slowdown in sales volumes and a reduction in the pace of value growth throughout 2022.”

Kearins says Reserve Bank hikes will not deter first-home buyers from purchasing property and locking in some good, fixed rates, as evidenced by CoreLogic’s latest bi-annual First Home Buyer Report.

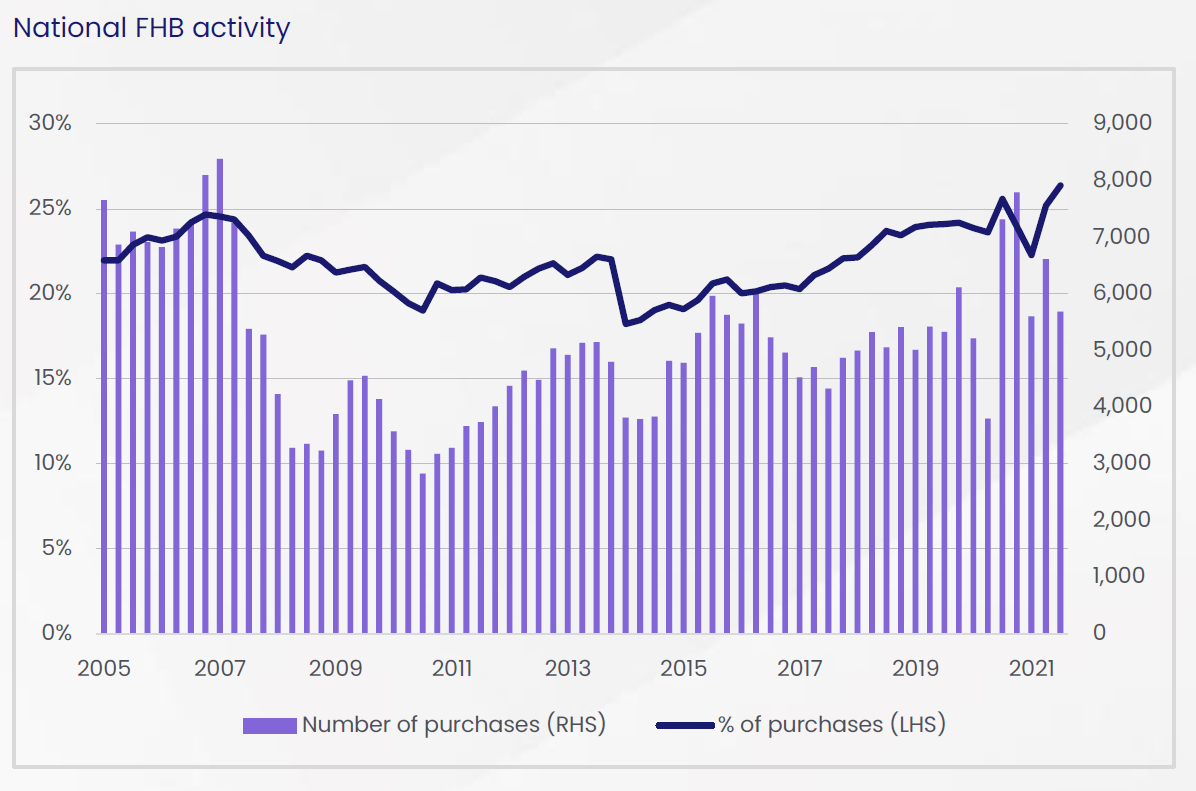

New Zealand first home buyers (FHBs) have hit record high market share over the third quarter of 2021, despite tough market conditions and rapidly rising house prices.

26.4% of all buyers in the three months to 30 September, 2021 bought a property for the first time, completing about 5,700 transactions.

During the same three-month period CoreLogic’s House Price Index revealed New Zealand’s average property value increased 4.8% to $950,229, up 27.8% for the 12 months to the end of September. Values rose a further 2.1% in October.

Davidson says the proportion of FHBs in the market between July and September 2021 was well above the long-term average of 21.8% and surpassed the previous benchmark of 25.6% set in the third quarter of 2020.

“We have to acknowledge that the underlying number of transactions has been disrupted by COVID and the lockdowns over August/September, so we need to take a little extra care when interpreting market share figures,” he says.

“However, it’s safe to say FHBs are very active in the market. The number of deals they were involved with in Q3 was the highest for the third quarter of any year since 2015, except for the same period last year, when we saw the figures ‘artificially’ pushed up due to the post-lockdown bounce.”

Despite the widespread boom in house price growth and associated larger deposits, Davidson says the share of purchases being made by FHBs has been unexpectedly strong in the past few months.

“One of the biggest barriers to home ownership is saving a deposit and in the past year it’s become progressively harder for aspiring FHBs to get those funds together,” Davidson says.

“The average time to save a deposit is now more than 10.5 years, up from less than nine a year ago, and well above the long-term average of around eight years. Buying with a deposit that’s less than the standard 20% has previously been popular among FHBs. However since the banks’ allowance for advancing low deposit loans to owner occupiers recently halved from 20% of lending flows to 10% that is no longer an option for many.”

KiwiSaver, which is being utilised for a home deposit, has been a key source of support for buyers Davidson says, while the trend among FHBs to compromise either on the type of property and/or location is gaining momentum.

Based on the CoreLogic Buyer Classification series, the Q3 2021 First Home Buyer Report analyses FHB activity in each part of the country. The report includes details on locations, prices paid and what types of properties FHBs purchased in the three months to September 30, 2021.

FHBs are defined as having never previously owned property in New Zealand before and a mortgage has been secured against the property to complete the transaction.

The national trends have been replicated across Auckland, Hamilton, Tauranga, wider Wellington, Christchurch, and Dunedin, as FHBs’ market share in the quarter registered above long-term averages by at least two percentage points.

Wellington recorded the highest share of FHB activity at 33% in Q3 2021, compared to the city’s long-term average of 29%. Dunedin recorded the most significant growth, registering a FHB market share figure of 30%, eight percentage points above its average of 22%.

First time property owners are paying slightly less than the rest of the market, notably in the country’s most expensive city Auckland, where FHBs paid a median price of $900,500 in Q3 2021. The figure is $149,500 less than the median price being paid by all buyers ($1,050,000) in Auckland.

The gap was also more than $100,000 in Tauranga, where FHBs paid a median price of $760,000 compared to Wellington, where $800,000 was the median price paid to get into the market.

FHBs in Christchurch paid a median price in excess of $500,000, but the figure remains lower than Dunedin, where the median price paid during the quarter was $566,125.

The most expensive FHB market across NZ’s main urban areas was Queenstown, where a median price of $860,000 was paid by FHBs, followed by Kapiti Coast at $777,500 and Palmerston North, Whangarei, Napier, and Nelson where FHBs paid more than $600,000. Amongst the main urban areas, Invercargill was the country’s lowest priced FHB market, with a median of $382,000 in Q3 2021.

Freestanding houses accounted for 72% of FHB purchases in Q3 2021, down sharply from the full-year figure of 78% in 2020, as affordability constraints forced buyers to consider flats. The percentage of flats – defined as townhouses and other shared wall properties – purchased by FHBs was 18%, up from 14% last year.

Davidson says FHBs were taking the opportunity to get into the market, capitalising on strong financial incentives to buy rather than rent, filling the gap left by a decline in mortgaged investors’ market share who faced tougher conditions due to tighter lending restrictions.

“It will be interesting to see if the FHB market share can hold up at similar levels in the coming quarters, given that the low deposit lending speed limit is now much tighter,” he says.

Key insights from this report include:

- From July to September 2021, FHBs had a market share of purchases of 26.4% – well above the average of 21.8%, and moreover a new record high.

- On average a FHB requires 10.5 years to save a deposit.

- Auckland FHBs spent a median $900,500 in Q3 2021 to get into the market compared to those in Invercargill, who spent $382,000.

- Standalone houses accounted for 72% of FHB purchases in Q3 2021 – down sharply from the full-year figure of 78% in 2020.

- FHBs have purchased relatively more flats (commonly a property with a shared wall that isn’t an apartment), with this property type now accounting for 18% of their activity, up from 14% last year.

- The median price paid by FHBs in Q3 2021 was $660,000, up from the figure of $565,000 for 2020 as a whole, but lower than Q2 2021’s number of $685,000 – when houses were a larger share of their purchases.