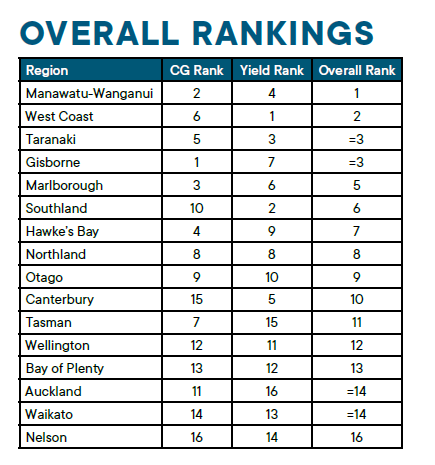

The Manawatu/Wanganui region had the second highest capital gains and the fourth highest yields, according to an REINZ report

Capital gains in the Manawatu/Wanganui region increased 25.3% for the three months ending December 2020 when compared to the same time last year with median prices going from $400,000 to $501,000. Additionally, yields in the Manawatu/Wanganui region were 4.0% thereby making it the standout region for residential property investors in New Zealand.

In second place in terms of providing strong returns for investors was the West Coast – the region that topped the list last quarter. The West Coast saw the highest yield in the country at 5.8% – the only region to exceed the 5% mark and the sixth highest capital gains in the country (up 20.2% from $209,000 to $251,200).

Followed closely behind was Taranaki, with the third highest rental yield at 4.1% and the fifth highest capital gains for the country (up 21.0% from $405,000 to $490,000).

At the other end of the scale, Nelson had the lowest capital gains (up 10.8% from $600,000 to $665,000) and the third to lowest annual yield of all regions (3.4%), making it the worst performing region for residential property investors.

“As house prices have continued to rise, we’ve seen yields continue to fall, showing that some of the strong yields we’ve seen previously are no longer available to investors,” says REINZ Acting Chief Executive Wendy Alexander.

“Again, the regions with the best returns for investors continue to be some of the smaller and more ‘affordable’ regions, which again points to the importance of due diligence before buying an investment property.

“Although there is the obvious convenience of a rental property in your region, sometimes there are advantages to looking ‘outside the box’ and considering where your best investment opportunities lie and factoring in the cost of using a property manager to offset the physical distance.”

Regional breakdown of capital gains

The regions with the biggest increase in capital gains for the 3 months ending December 2020 compared to the 3 months ending December 2019 were:

-

Gisborne with a 36.6% increase from $410,000 to $560,000

-

Manawatu/Wanganui with a 25.3% increase from $400,000 to $501,000

-

Marlborough with a 23.6% increase from $466,000 to $576,000

-

Hawke’s Bay with a 21.7% increase from $530,000 to $645,000

-

Taranaki with a 21.0% increase from $405,000 to $490,000.

The lowest capital gains in the country were in Canterbury and Nelson with gains of 12.9% and 10.8% respectively.

“Every region in the country experienced double-digit increases in capital gains in Q4 with 6 out of 16 regions seeing uplifts in excess of 20% – a remarkable result given initial forecasts for a post-COVID housing environment,” says Alexander.

“The factors supporting this growth have been well documented, but include the removal of the LVRs, low interest rates from the major trading banks, a shift of spend from overseas travel to residential property and the fear of missing out as prices look set to continue rising in the next 6 to 12 months,” she continues.

Yields

The regions returning the biggest yields to investors for the 3 months ending December 2020 compared to the 3 months ending December 2019 were:

-

West Coast with a yield of 5.8%, down from 6.7%

-

Southland with a yield of 4.5%, down from 4.8%

-

Taranaki with a yield of 4.1%, down from 4.6%

-

Manawatu/Wanganui with a yield of 4.0%, down from 4.6%

-

Canterbury with a yield of 4.0%, down from 4.4%.

“Again, we’ve seen rental yields fall across the board, with not a single region seeing an annual uplift in yields, a trend we’ve seen for some time now.

“Additionally, not a single region had a yield in excess of 6% and for the first time we’ve seen Auckland yields fall below the 3% threshold for the first time showing just how tough it is if you’re an investor relying on strong yields from their investment portfolio.

“However, according to the Reserve Bank data, lending to investors in this quarter increased by 71.1% as people took the opportunity to take advantage of the removal of LVRs and low interest rate environment suggesting that investors are happy to take a longer-term approach to investing,” concludes Alexander.

Residential property remains a safe bet

Century 21 New Zealand Owner, Derryn Mayne says residential investors are taking a deep breath following the Government’s March housing announcements. Interest tax deductibility was wiped for investors and the bright-line test was extended to 10 years – taxing capital gains.

“We’ll definitely see fewer ‘mum and dad’ landlords enter the market with minimum deposits lifting to 40% for investors from 1 May,” Mayne says.

This week, Tony Alexander’s Mortgage Advisers Survey reported more brokers ‘are seeing less business come through the door from first-home buyers’. At the same time, the survey revealed less investors are seeking mortgage advice, concluding that policy changes aimed at dampening investor demand for existing properties were having the desired result.

Mayne says many of Century 21’s franchises nationwide, which oversee large property management portfolios, are reporting the Residential Tenancies Amendment Act 2020, which took effect in February, is also having an impact on investor decision-making.

“Not only is it harder to get into residential investment property, but there are many new challenges for existing landlords,” she says.

“Subsequently, we’re seeing small and large landlords exiting out of residential property. They’re opting instead to invest in the likes of the sharemarket, managed funds, commercial property, or even syndications promising a reasonable yield on commercial buildings.”

Despite government and Reserve Bank measures to cool off investors, the Century 21 leader says residential property remains a safe bet for those who factor in that one day the record-low interest rates will inevitably rise.

“If you put money in the bank these days, you’re sadly going backwards. With the best 12-month term deposit rate sitting at barely one percent, when you minus tax and factor in inflation, there’s no income or gain there. Residential property, however, will always provide both.

“With the autumn market seeing some reticence creeping in, for those still willing and able to get into investment property, they might be surprised at the opportunities now out there,” says Mayne.