The greater-than-expected shift in US trade policy was the major surprise in the first half of 2025, according to the CBRE mid-year review of APAC commercial property rentals.

Although April’s initial shock from the US subsequently calmed after tariffs were lowered and several trade deals were signed, ongoing uncertainty continues to drag on regional economic and business sentiment.

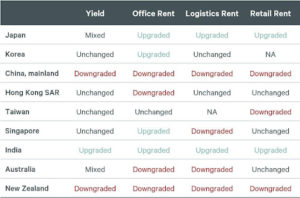

As a result, CBRE has revised down its 2025 GDP growth forecast for Asia Pacific from 4.1 percent to 3.7 percent. Australia, New Zealand and China all suffered downgrades on rental expectations for the second half of the year and beyond.

While US interest rates were unchanged in the first half of 2025, monetary policy in many Asia Pacific economies has turned more stimulative in response to weaker growth.

Several central banks implemented more aggressive than expected rate cuts during the period. In Japan, the Bank of Japan (BoJ) may resume rate hikes before the end of the year after the country reached a deal in July with the US on tariffs.

CBRE has upgraded its 2025 full year investment forecast to growth of between 10 and 15 percent on the back of solid investor demand in markets such as Korea, Japan and Singapore.

Strong fund-raising activity and enlarging positive yield spreads in most markets are likely to provide ongoing support to investment, although yield performance will continue to diverge.

Office sentiment softened in Q2 2025, with most markets reporting slower enquiries and decision-making. However, office leasing activity could pick up in the second half amid stabilising business confidence and tighter return-to-office mandates. CBRE expects office leasing activity to be on par with that in 2024.

CBRE’s 2025 Asia Pacific Logistics Occupier Survey revealed a decline in optimism, with many tenants planning to right-size portfolios and restructure supply chains.

However, logistics leasing volume is expected to remain steady, driven by landlords’ more flexible stance; resilient demand from domestic consumption-related firms and occupiers planning mid-to-long term expansion.

In the retail sector, weak consumer sentiment and subdued discretionary spending prompted retailers to be more cautious towards real estate planning in in the first half of 2025. Retailers’ strong preference for prime core locations will ensure vacancy rates continue to decline but the pace of rental growth will remain mild.

Hotel Average Daily Rates continue to grow in most markets while occupancy is improving as hoteliers adopt different pricing and operational strategies to boost performance. Japan, Korea, Vietnam and India are set to lead Revenue Per Available Room performance for the full year.