As AI adoption accelerates across the Asia Pacific, organisations are taking a more strategic approach to integration, focusing on GenAI use cases that enhance operational efficiency, boost productivity and deliver personalised customer experiences.

This IDC InfoBrief is an essential read to understand the inevitable need and the effect of AI and its derivatives on any size business which wants to remain competitive

AI implementation is not without challenges – businesses continue to grapple with a shortage of skilled talent, particularly in developed markets where competition for AI expertise drives up costs.

Additionally, the success of AI initiatives hinges on the availability, quality and governance of data. Addressing these factors through a combination of internal investment and external collaboration is key to unlocking AI’s full potential.

Artificial Intelligence (AI) has advanced beyond the experimental phase with Generative AI (GenAI) technologies. In 2024, organisations began to adopt a strategic approach to AI integration, focusing on real-world applications.

The AI-centric server market in Asia Pacific is expected to reach AU$366 billion by end of this year. Already 21 percent of organisations across Australia and New Zealand reported quantifiable improvements from AI and Machine Learning (ML) cases and five percent identified AI capabilities as core to their competitiveness.

The report examines key trends in AI platforms, such as the integration of large language models (LLMs) into enterprise systems, the rise of unified AI architectures and the emergence of GenAI feature stores as standard libraries to accelerate model development.

It covers trends in technology investment, data and infrastructure priorities, deployment preferences, functional use cases and industry-specific insights.

The growth trend is set to gain further momentum this year, with an increasing focus on predictive, interpretive, and GenAI-use cases which streamline internal processes, boost productivity and enhance personalised customer experience.

InfoBrief, sponsored by DELL and NVIDIA, forecasts that the AI-centric server market in Asia Pacific is expected to reach AU$23.9 billion by the end of this year.

“The Asia Pacific region holds immense potential to lead the way in AI adoption and innovation,” says DELL Senior Vice President Chris Kelly.

“Now is the time for enterprises to move beyond proof of concepts and focus on achieving a measurable return on investment (ROI)”.

Businesses will need AI to improve efficiency, reduce costs, and enhance the customer experience. Investing in AI-optimised hardware and software, such as AI-powered PCs, high-performance AI servers, data storage and cloud infrastructure, support innovation and drives long-term growth and competitiveness

This momentum is expected to continue into 2026 and beyond, as organisations recognise AI’s potential for market differentiation and operational excellence, fuelling innovation and unlocking new opportunities for competitive advantage and business transformation, the report says.

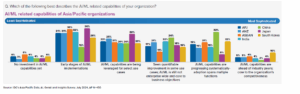

As AI adoption accelerates, enterprises across the region are aligning their strategies with investment and skills development, though some organisations still expand AI through opportunistic pilots.

Challenges ahead

The AI skills shortage remains a challenge, exacerbated by high compensation competition, particularly in developed countries. Furthermore, data availability, quality, governance, and management are critical to AI’s success.

Although businesses see vast potential to enhance productivity and customer engagement with these technologies, many still face challenges. AI, GenAI, and ML may be transforming industries across APAC but many organisations struggle with talent shortages, integration complexities and aligning AI strategies with business objectives and existing workflows.

The essential read

InfoBrief, sponsored by DELL and NVIDIA highlights how technology partners can help businesses bridge these gaps, ensuring a smooth AI adoption process while maximising efficiency, innovation, and competitive advantage.

The report delves into the foundational aspects of enterprise AI and GenAI initiatives, including technology, talent, and data strategies, while highlighting key challenges organisations face in scaling AI.

For technology buyers, it provides essential guidance on assessing AI readiness, pricing strategies, and the optimal mix of build, buy, and compose approaches in line with business transformation goals.

The report also emphasises the importance of evaluating IT infrastructure requirements, optimising the data value chain, and ensuring seamless integration to drive successful AI adoption and long-term growth.

“The journey to consistent ROI is complex and requires comprehensive support across every stage — strategy, use case development, data preparation, governance, optimisation, and scaling AI implementations,” says Kelly.

“With the support from technology partners, enterprises can overcome adoption challenges and accelerate their path to impactful, results-driven AI outcomes.”

Transformation underway

A wide variety of industry sectors across APAC are being transformed by AI, GenAI and ML, with organisations adopting AI-driven strategies to improve operations, enhance customer experiences and drive innovation.

The region is rapidly adopting GenAI-use cases, with 87.4 percent of survey respondents say they have deployed more than 10 GenAI-use cases in 2024. A quarter of them say they will have more than 100 GenAI-use cases by the end of 2025.

This year, 84 percent of Asia Pacific organisations intend to allocate between AU$1.5 to $3 million towards GenAI initiatives. While organisations globally dedicate around 33 percent of their budgets to GenAI, 38 percent of AI budgets in APAC are allocated to GenAI, compared with 61 percent combined for predictive and interpretative AI.

AI deployment

AI and GenAI deployment strategies are evolving in the Asia Pacific, with public cloud (including multicloud) as the top choice in 2024. However, there is a growing need for private AI and on-premises deployment, driven by security, cost efficiency, improved data sharing and collaboration plus industry-specific requirements.

Businesses are shifting from generic to specialised AI models, with CIOs prioritising data security, system integrity and optimised infrastructure choices across public, multi-cloud, hybrid and private cloud environments.

Scaling AI and GenAI

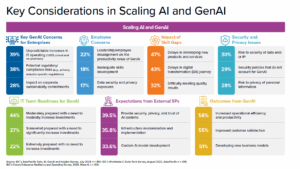

Enterprises face key concerns when scaling GenAI, including rising IT costs, regulatory and compliance risks, while meeting energy efficiency commitments.

Skills gaps can delay digital transformation, slow product development, and impact quality outcomes – more 72 percent of enterprises in APAC stress the need for data and AI knowledge in new hires to bridge the gap in skilled AI talent.

Security and privacy

Security and privacy remain major concerns. IT teams must enhance readiness for GenAI adoption, while organisations expect external service providers to ensure AI system security, privacy, trust, infrastructure modernisation and custom AI model development.

Despite the challenges, businesses see GenAI as worth the effort since it is a driver of operational efficiency, improved customer satisfaction, and the creation of new business models.

Groundwork for success

Organisations in APAC are taking a structured, phased approach to AI adoption, prioritising high-impact use cases that deliver measurable benefits while managing risks. A strong AI foundation requires a marriage of people, process and technology.

Key focus areas include investing in AI-ready infrastructure, fostering AI-centric teams, aligning AI strategies with business goals, and implementing robust data governance to drive decision-making and long-term AI success.

Strategic partners

Organisations in APAC cite talent shortages, data privacy concerns, and integration complexities as key barriers to AI success.

Many businesses in Australia and New Zealand recognise the value of partnering with strategic experts to build scalable infrastructure and bridge skills gaps. More than 60 percent rely on external developers for AI applications, while only 30 percent develop AI in-house. Around 10 percent use commercial off-the-shelf AI solutions.

Organisations turn to technology partners for AI roadmaps, robust and scalable infrastructure, expert implementation support and workforce training to bridge internal capability gaps and accelerate AI deployment.