Flexible office space is expected to take a bigger share of the market post-pandemic despite poor short-term forecasts

“Flex space”, including co-working centres and serviced offices, has expanded rapidly over recent years, driving 109,000sq m – or 31 per cent – of net absorption in Australian office markets over 2018 to 2019, according to the latest CBRE research market snapshot.

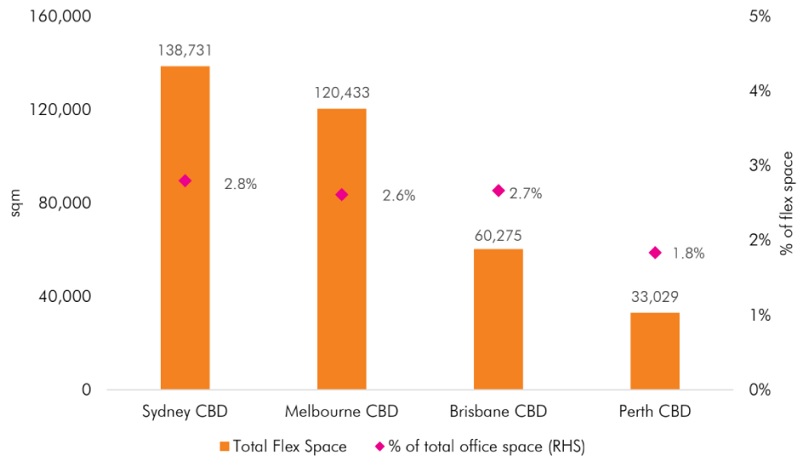

Flex operators now occupy about 353,000sq m of office space in the Sydney, Melbourne, Brisbane and Perth CBD markets; however widespread lockdowns over April and May saw footfall within flexible space centres drop 70 to 90 per cent.

Footfall has remained 10 to 20 per cent below 2019 levels even in locations with the strongest recovery.

According to further data by the Business Research Company there has been 12.9 per cent global decline co-working revenue during 2020 this model is also expected to recover in the next few years at a compound annual growth rate of 11.8 per cent.

Flexible office market share

Source: CBRE the Future is Flex

Despite difficulty seen during Covid for office market with leasing disputes and negative net absorption a Colliers International forecast report also expects the sector to re-balance by 2023.

CBRE head of Pacific advisory transaction services Mark Slater says as lease expiries occur over the coming years, they expect that more office occupiers, larger ones in particular, will adopt new work models.

“While we expect to see some contraction and consolidation, the economy will ultimately turn upwards and with this, the demand for office space will grow again,” Slater says.

“It’s in this environment, that on-demand and flex space will augment the needs of organisations that put their pre-Covid space expansion plans on hold as occupiers return to the workplace,” he continues.

“We also expect that landlords will become larger players in the provision of flex space through their own offering or partnering with operators,” says Slater.

In the medium term the CBRE report predicts there will be a demand for flexible and on-demand space as occupiers return to the workplace while pre-Covid expansion plans would be put on hold.

Long term, those who survive the downturn will look to the next evolution of working strategies with landlords providing more flexible space or partnering with operations to accommodate new models.