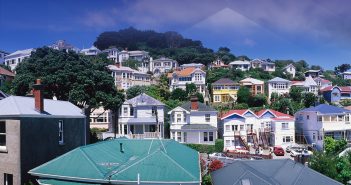

Housing market facing challenges for rest of 2022

Sharply rising interest rates and the large wave of refinancing of existing mortgages that will occur over the next year will test the declining property market, CoreLogic NZ Chief Property Economist Kelvin Davidson says

CoreLogic’s quarterly market overview confirms that the slowdown of sales activity in the first quarter of 2022 has flowed through to a marked decline in property values and was one of many challenges to hit the market. Continue →