November saw 9,885 properties sold, the highest since March 2007, but will a lack of listings and rising house prices hinder a strong looking summer?

The number of residential properties sold in November across New Zealand increased by 29.6% from the same time last year (from 7,627 to 9,885). For New Zealand excluding Auckland, the number of properties sold increased by 18.3% when compared to the same time last year (from 5,205 to 6,157).

In Auckland, the number of properties sold in November increased by 53.9% year-on-year (from 2,422 to 3,728) – the highest November sales volume since records began.

In addition to Auckland, regions with the largest increase in annual sales volumes during November were:

- West Coast: +74.4% (from 43 to 75 – 32 more houses) – the highest since March 2004

- Northland: +36.1% (from 219 to 298 – 79 more houses) – the highest since June 2016

- Canterbury: +31.7% (from 1,012 to 1,333 – 321 more houses) – the highest since March 2007

- Bay of Plenty: +29.5% (from 498 to 645 – 147 more houses) – the highest since May 2016

- Nelson: +25.8% (from 93 to 117 – 24 more houses) – the highest for the month of November in 18 years

- Waikato: +21.9% (from 828 to 1,009 – 181 more houses) – the highest since September 2015.

“November was an incredible month in terms of the number of properties sold, with just shy of 10,000 properties sold over 30 days (9,885),” says REINZ Chief Executive, Bindi Norwell.

“The last time we saw a similar level of sales volumes was back in March 2007 – 164 months ago – before the national recession and Global Financial Crisis started impacting New Zealand’s property market.

“More than half (10 out of 16) of the regions across the country saw double-digit percentage increases in annual sales volumes. Part of this is likely to be attributed to people wanting to purchase property ahead of Christmas, partly due to the Reserve Bank announcing in early November that it would undertake a consultation in December to re-introduce LVRs earlier than planned, but also due to this underlying fear that prices might increase even further in the coming months.”

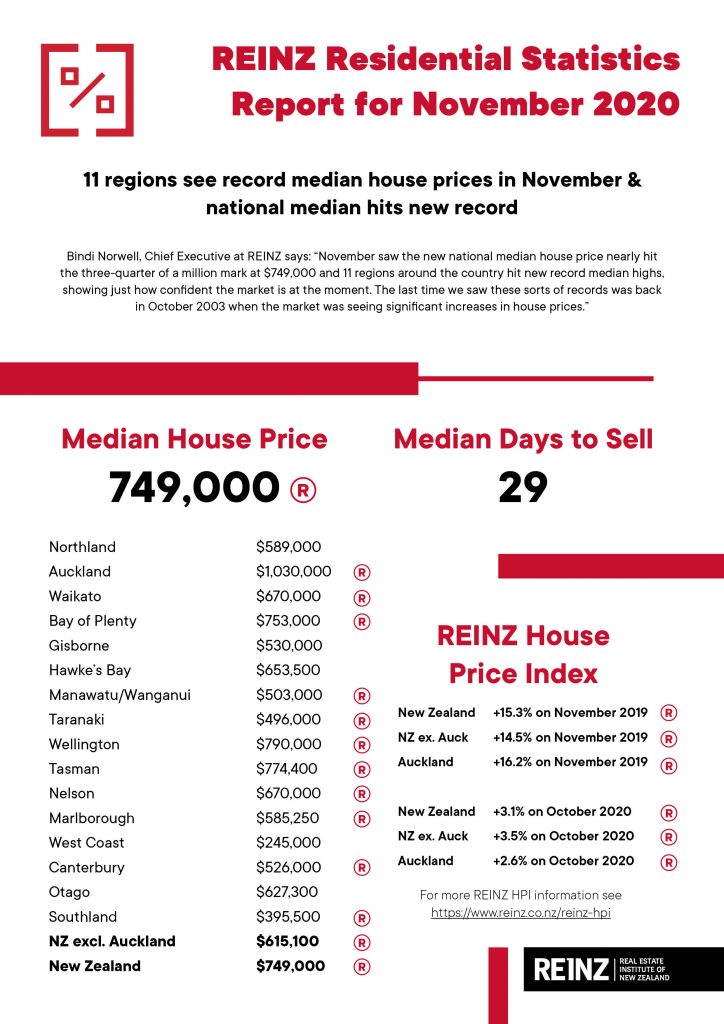

The median number of days to sell a property has also dropped to 29, the lowest since March 2007. Across the country, 11 regions had a median number of days to sell of less than 30 days – the last time we had at least 11 regions at less than 30 days, was in December 2003.

Taranaki and Southland had the lowest days to sell of all regions at 21 days – down 7 days and up 3 days respectively from the same time last year. This was the lowest equal days to sell for Taranaki since records began.

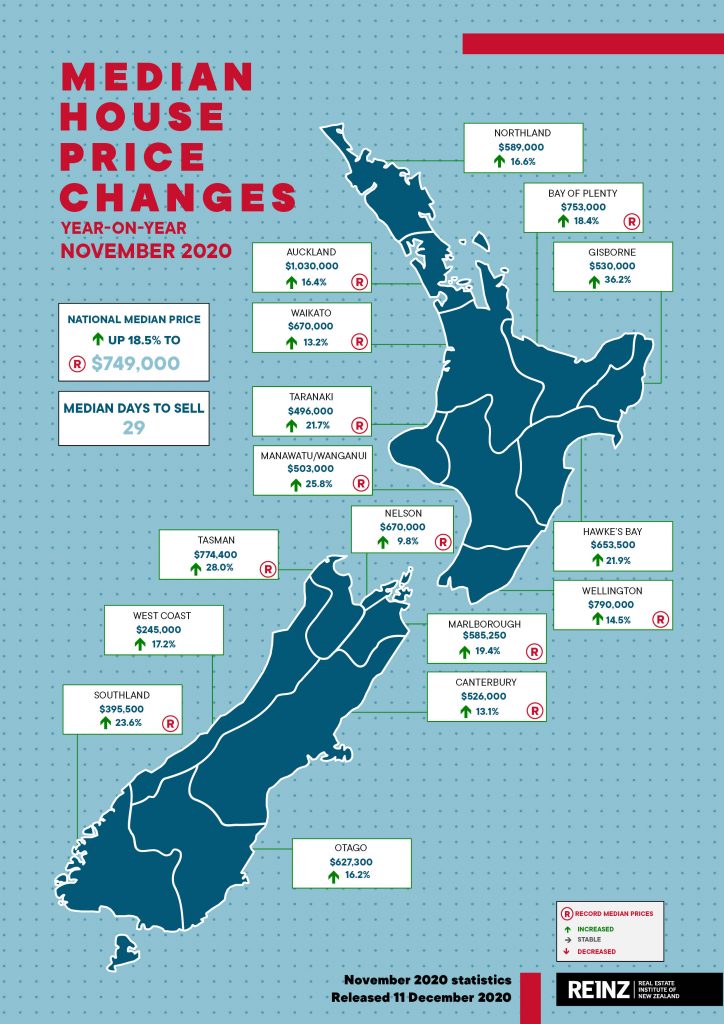

New record median house price

Median house prices across New Zealand increased by 18.5% from $632,000 in November 2019 to a new record median high of $749,000 in November 2020; and up from $725,000 in October this year – a $24,000 increase.

Median house prices for New Zealand excluding Auckland increased by 15.0% from $535,000 in November last year to a new record median price of $615,100, and up from $600,001 in October (a 2.5% increase).

Additionally, Auckland’s median house price increased by 16.4% from $885,000 at the same time last year to $1,030,000 a new record high, and up $30,000 from $1,000,000 in October this year (a 3.0% increase).

In total 11 regions saw record median prices during November. Regions in addition to Auckland with record median prices were:

- Tasman with a 28.0% increase from $605,000 in November last year to $774,400 this November

- Manawatu/Wanganui with a 25.8% increase from $399,750 in November last year to $503,000 this November – the first time the median price has gone over the $500,000 mark and the fifth record median price in a row

- Southland with a 23.6% increase from $320,000 in November last year to $395,500 this November

- Taranaki with a 21.7% increase from $407,500 in November last year to $496,000 this November

- Marlborough with a 19.4% increase from $490,000 in November last year to $585,250 this November

- Bay of Plenty with a 18.4% increase from $636,000 in November last year to $753,000 this November

- Wellington with a 14.5% increase from $690,000 in November last year to $790,000 this November

- Waikato with a 13.2% increase from $592,000 in November last year to $670,000 this November – the seventh month in a row of record high medians

- Canterbury with a 13.1% increase from $465,000 in November last year to $526,000 this November

- Nelson with a 9.8% increase from $610,000 in November last year to $670,000 in November this year

“The last time we saw these sorts of records was back in October 2003 when the market was seeing significant increases in house prices,” says Norwell.

“This just isn’t sustainable and with data out earlier this week showing that home ownership is at its lowest level in 70 years, the gap between those that own and those that rent is just going to keep growing unless we can do something to start addressing the supply issue the country has.”

Inventory levels lowest ever in eight regions

The total number of properties available for sale nationally decreased by 16.9% to 18,319, down from 22,049 in November 2019. Additionally, 8 regions (Bay of Plenty, Hawke’s Bay, Manawatu/Wanganui, Marlborough, Nelson, Northland, Waikato and West Coast) had their lowest levels of inventory ever.

Hawke’s Bay, Manawatu/Wanganui, Wellington and Nelson all had the lowest number of weeks’ inventory with only six weeks inventory available to prospective purchasers highlighting how we desperately need new listings to come onto the market in some parts of the country.

“Kiwis should take the opportunity to market their house this summer,” says Century 21 New Zealand Owner, Derryn Mayne.

“As these latest REINZ numbers reinforce, the coming months will be strong. Summer is looking really good, but those contemplating selling their house shouldn’t muck around. Vendors need to consider that come March, the mortgage holiday scheme ends with LVRs also set to return. Autumn and winter could be quite different.”

“With interest rates hitting rock bottom, the economy doing better than expected, listings still light, and buyer demand hot, this summer could be the best one in real estate for over a decade.”